While running a business, there are many things that you need to consider to make sure your business keeps running smoothly. The most important thing for that is how you treat your employees. Many factors come into play when trying to keep your employees happy. Is the work environment healthy? Do the employees feel valued? Is there a steady work-life balance? All of these questions correlate to one thing, and that is payroll. A company’s payroll operations play a significant role in keeping the morale among the employees high. If there are errors in payroll, the motivation among the employees can go down like a deck of cards.

As fatal as errors in payroll can be, they are prevalent and easy to make. Things like simple calculation mistakes can turn your payroll into a colossal mess. Calculation mistakes are not the only errors you can make while doing your payroll. In this blog, we’ll go through a few common payroll mistakes that businesses make and how you can avoid them.

Common Payroll Errors:

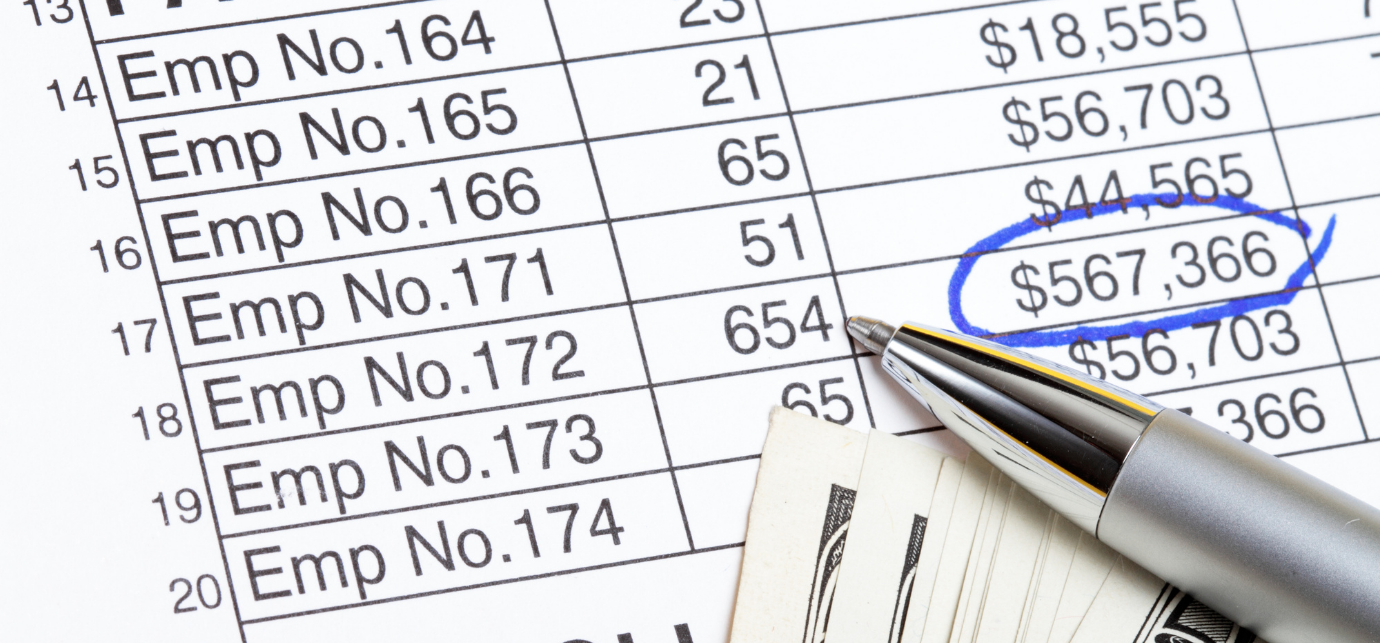

1- Making errors while calculating pay:

Calculation errors are easily the easiest and most common errors companies make while doing their payroll operations. Even a tiny miscalculation can take several days to fix because you’ll have to trace where the error came from and then fix it. It will not only take a lot of time to redo your payroll, but it will also cost you money order to do your payroll from scratch. Miscalculations can result in deductions and underpaying your employees, which is never ideal for running your business smoothly.

2- Errors in tracking overtime and employee hours:

Miscalculated overtime can result in a lot of payroll errors. If you don’t have the correct data regarding how many hours an employee has worked, you will make payroll mistakes. The errors can be of a few different types. An employee who worked overtime will be underpaid when his overtime is not calculated correctly. Similarly, an employee can also be underpaid if his regular hours are miscalculated. Errors like this will make you do your payroll all over again, which is never ideal.

3- Missing deadlines:

Every employee likes to be paid on time, and missing deadlines will make them upset. Missing payroll deadlines can happen if your company doesn’t have a steady schedule to roll out employee payments. If your employees expect to get paid at a specific date, then missing that deadline will only end with them being unhappy. Since payroll is a long and tiring process, it is easy to miss an important deadline. Planning for your payroll operations a few days in advance can help you keep the deadlines in check.

4- Incorrectly classifying employees:

Usually, there are two types of people that work in a company. They can either be independent contractors, or they can be an employee. If you cannot classify the employees correctly, it can again result in significant payroll errors. Mixing up these two can result in underpaying or overpaying certain employees. This mistake can also result in penalties and taxes that you’ll have to pay to the employees.

5- Not keeping payroll records:

Not keeping accurate payroll records can result in an audit. Other than that, payroll records can help you if you want to look at an employee’s payroll history or want to look for a form. Different rules apply to other states and countries, and not following those rules for payroll records can result in penalties and fines.

How to avoid common payroll errors:

1- Revaluate your payroll services provider:

If you have outsourced your payroll services to a firm, it is improbable that there will be any mistakes. But if your services provider is making constant mistakes that result in losses for you, revaluation is the best thing to do. Talk to your services provider, review where the mistakes are occurring and ask them to change their approach. If the errors still occur, move on to a better services provider with a good reputation.

2- Develop a payroll schedule:

Having a steady payroll schedule can make many of your payroll errors go away. Missing deadlines is a standard payroll error that you can take care of by having a regular schedule. A schedule helps you get ahead of yourself and plan for any ambiguities and difficulties that might occur in the future. You can identify where you have been lacking in the past, and you can develop your schedule so that you can always have an extra cushion for that.

3- Get the best tools:

Automating your payroll operations is an excellent way to avoid payroll errors. Automation also saves you a lot of time and resources. But getting the right payroll software for your company is a tough ask. Several payroll software on the market might have great reviews but still won’t suit your business. Identifying the needs of your business and investing in the right tools will go a long way in making your payroll process smooth.

4- Double Check:

Before rolling out payroll, always double-check what you have done. Payroll is a long, arduous process, and it is straightforward to make mistakes while doing it. So before you roll it out to your employees, always remember to double-check for any errors and mistakes. Because I assure you, there will be some.

Conclusion:

Doing your payroll operations is never an easy job, and it takes a lot of time and resources, yet it is prone to so many errors and failures. These are just a few of the common payroll errors that might occur.

While you can avoid most payroll errors by following the steps mentioned in the blog, there is a better way. Outsourcing your payroll operations is the best possible way to eliminate payroll errors. Firms hire resources that are best on the market to eliminate payroll errors. So, if you are looking to outsource your payroll services, Taxboox provides the best payroll services in the USA. Visit our website to know more.