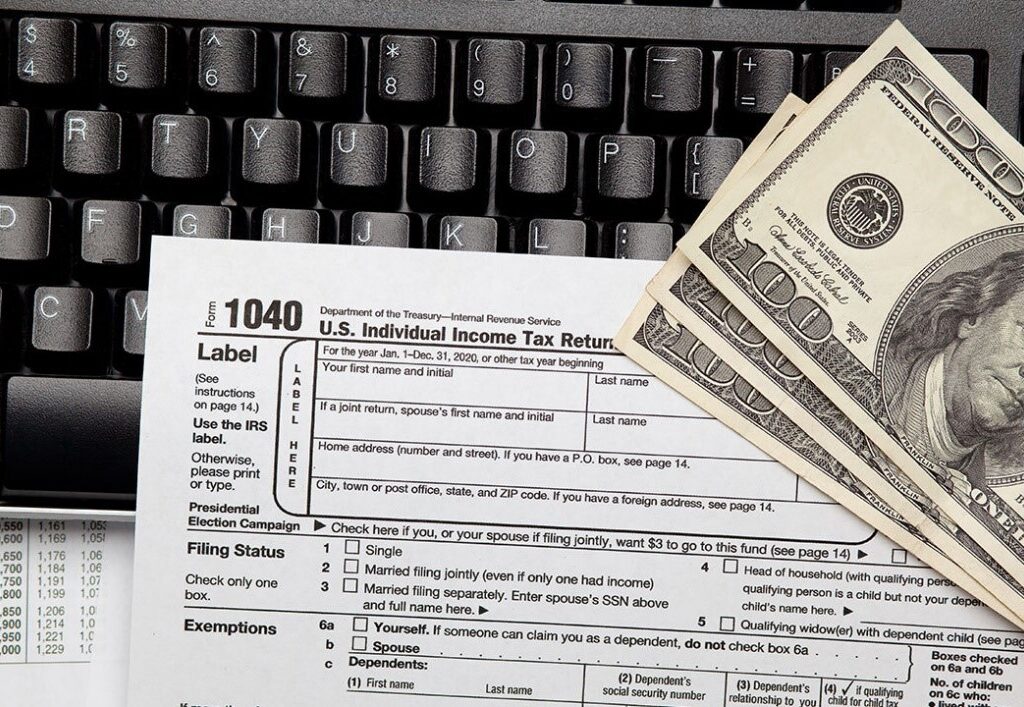

Tax preparation is an essential part of a business as it links to business earnings and expenses. The organization paying taxes can do tax preparations either online or with the help of software designed for the preparation of taxes.

It is a process that involves income tax returns for your business. There are three ways for tax preparation that you can choose. You can do all the paperwork yourself by filling out the forms and documents. Secondly, you can use specially designed tax preparation software that does all calculations and paperwork for you. And last, you can hire a tax professional who will take care of all the technicalities including, tax calculations and paperwork.

Many tax preparation organizations work on behalf of companies or a sole person. They have experts that know to do calculations, filing, and signing of income tax returns. Tax preparation is a required part of your business success and growth.

What do I need to gather for Tax preparation?

- Tax Preparation Mechanism

The tax preparation procedure varies from business to business. It includes using accounting software, hiring a tax professional, or getting help from an accountant.

2. Arrangements for Tax

The tax preparation task can be very hectic and time-consuming. First, you have to go through all your financials, earnings, and documentations. Many organizations use accounting software to keep an eye on the cost. You also need to know if there is any update on tax laws and regulations. For this purpose, you should consult your accountant: he can provide any further information and take down the necessary measures. You should know as well how much does it cost to get taxes prepared.

3. Timeline for Tax Returns

The income tax preparation firms are immensely busy during the tax period. You can get expert services for your business and distinctive tax return. Usually, IRS takes two to four weeks to process your tax returns once you submit your request. The timeline depends on the workload and also if the organization is not very occupied. The time may exceed depending on the availability.

4. Documentation

It is necessary to complete all the documentation and keep all the paperwork for the record. You should keep all the forms and receipts in case of damages or deductions. Keep a record of seven years if your claim involves loss. If you are not aware of the tax documentation, you can ask your accountant. The United Way Volunteer Tax Preparation is for those that need help with tax preparation. It is a free program so, you can consult them right away.

What is the importance of Tax Preparation?

Tax preparation refers to the preparation and filing of income tax returns. There is a majority of US citizens that are not in favour of tax rates. The research says that most people think that the tax rates are quite a lot. If you are buying a burger worth $10, the only thing you will feel extra is the amount of tax on it. It irritates somehow to pay extra in any way on something you bought with your money.

If you are confused about your tax preparations, you can get a consultant service. It will help you in making sure that the tax deduction is fair and there is no ambiguity. You can also join a free tax campaign in your area to get answers to your queries.

We will discuss in a nutshell why you need a tax expert service and the importance of it.

1. Keep away from Error:

It is more beneficial to hire a tax professional for your tax preparations rather than doing it yourself. If you have a large setup and there are technicalities in accounts, you may face confusion in setting up the things. A slight error can cause an enormous sanction. When you hire a professional, you will be at peace of mind from any such mistakes. Tax preparation Austin makes it easier for you to prepare for your taxes.

2. Peace of mind:

By getting expert help, you will save time and energy. It is not an easy task to do all calculations and then the paperwork. You might have multiple accounts so, it’s a recommendation to get expert help. You will be free from all the stress that you may get in this task. The calculations can be complicated; you may not get them correct. So, when you get a professional’s help, it will give you a sense of relief.

3. Tax mandate:

The tax policies and regulations are tentative. You should be completely aware of tax rules and, it’s not a piece of cake. The tax preparation professionals are well informed about state tax rules. You can get to know about your current laws and policies with the help of a professional. It will save you from any uncertainty that might be against the law.

4. Thrift Process:

If you don’t have enough knowledge of tax preparations, you might come across difficult situations. You might be late in submitting the tax filing when you get stuck with something. You can violate tax regulations unknowingly or, you can make fatal mistakes or errors. Employing a tax professional saves you from all of these. The employment will cost you some dollars for sure but, it can also retain you from paying a cost if something goes wrong.

5. Audit composition:

There is a possibility that you have to go through the audit process in a particular situation. The audit should be translucent because you will be presenting it to the IRS. The tax preparation professionals have hands-on experience with the audit handle. Therefore, you can efficiently represent your documents and reports to the audit unit.

Epilogue:

You need not baffle by the tax preparations. The tax experts will make this process smooth for you. The receipts, documents, calculations must be with you and should be accurate. You can get tax help in your area of living. You will get the service for tax arrangements, paperwork, IRS audit report.

So, there is no hesitation in getting an expert service for your tax preparation task. It will retain your time and cost and, you will be free of the stress.

Add a Comment